Terminal cTrader is one of the latest technologies in the field of online trading. It is designed to work with ECN accounts and combines state-of-the-art tools and features that can meet the needs of both beginners and professional FOREX traders. Its users receive the highest execution speed and have the ability to control the full amount of current market quotes so that they can trade at the best prices for them.

cTrader trading platform provides full STP access to forex currency market for professional and novice traders. The ECN cTrader trading platform uses Straight Through Processing (STP) technology to process orders, allowing you to trade forex directly with the world’s leading banks (Deutsche Bank, Bank of America, Citigroup, Goldman Sachs, Barclays Plc., JP ChaseMorgan, Credit Suisse, UBS), excluding broker intervention. No Dealing Desk – Trading without a dealer (NDD) order processing guarantees one-click execution of forex trading at market prices.

Brokers to work with cTrader platform: Fibo Group, TeleTrade, Alpari, Alpha Forex, FxPro

cTrader is a response to the rapidly growing needs of both traders and brokers (who have been forced by traders). This platform was established from the very beginning, solely for the purpose of providing brokerage services on the spot and instruments market. CFDs based on the STP/ECN model. The first broker to introduce cTrader in its proposal (December 2011) was FxPro.

Advantages of the cTrader trading platform:

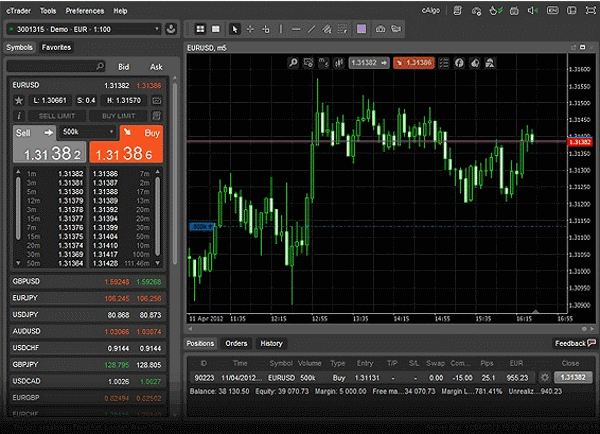

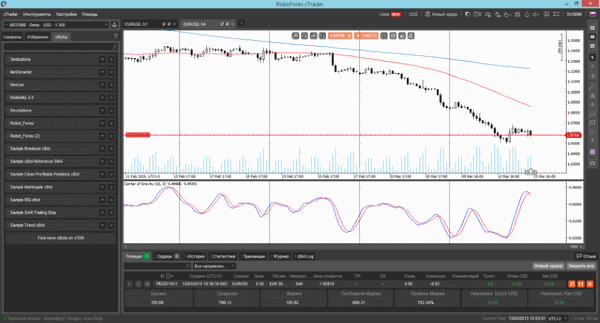

1 Instruments: a large list of trading instruments (83 currency pairs in the FOREX market, as well as metals); Graphics: the cTrader terminal is versatile, so you can create unlimited graphics and customize different modes, layouts and patterns. Also in cTrader, you can open the graphics in separate windows with all the features; Indicators: a complete set of tools needed for effective technical analysis, including more than 50 indicators with the ability to combine and optimize them, as well as develop their own scripts; Convenient interface with multiple price glass settings ChartShots and ChartCasts features to share experiences and ideas with other traders; quick access to the most frequently exchanged tools. the ability to trade via the online interface.

Disadvantages of the cTrader trading platform:

1 The main disadvantage of the platform is the specificity of its use – ecn account.

Offers

Platforms usually offer several different trading options, so the trader can choose the most convenient method for them. The car could not be different.

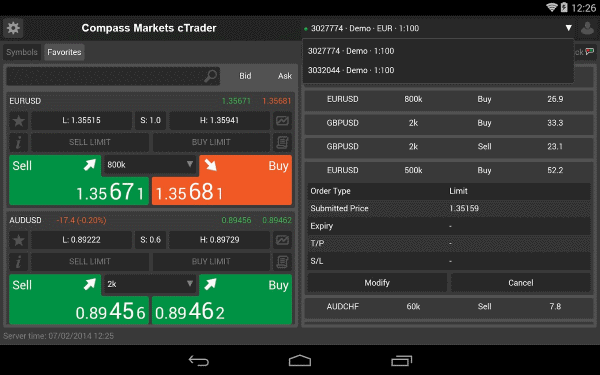

One-click trading is available from the chart (top). We can quickly open a position and determine the volume – in the form of a small bar under the trade, the mood among the broker’s clients is also visible. Interesting “flavors”, but generally useless. The second way to enter a position is to open the trading window. Here we can specify the SL/TP parameters before making a transaction. Useful information is the amount of loss expressed in interests and currency depending on the settings. This definitely makes risk management easier. This is the slowest way to open a position, but by far the least prone to possible errors on our part. The third way is to use the transaction bar on the left. In my opinion, he is very “gifted”, so he lost not only transparency, but also functionality. In addition to the classic Buy/Sell buttons, it is equipped with DoM (price glass), which is the depth of the market, where we can see how liquidity is distributed at different price levels. DoM is available in three versions: VWAP, Standard, Price. It is difficult to say whether these modes are useful for any trader, given how unstable and chaotic the Forex market can be. However, if someone deferred orders, close to the current market price, will certainly discover great potential cTrader. 101,000 Useful option – specify trading settings with one click. You can double them or disconnect them completely (you need to go to the transaction window). In the same window we can adjust the default price slip and automatically add SL, TS and TP with specific parameters to each open position.

Order time is one of the main advantages of this platform because orders are executed in a split second. Simultaneous order execution is also supported, so if a trader opens multiple trades at the same time, he does not have to wait no queue. The full range of displayed prices depends directly on the capital providers. Orders are filled with a weighted average trading volume price (VWAP).

Chart support

In addition to the three standard chart types, namely candlesticks, histogram and line charts, there is also a scatter chart or a “scatter” chart. This is a very niche feature, although some use it. The number of time intervals is amazing. Well, there are all of them… 26 plus 13 tick intervals.

The choice is really great – there are even niche TFs such as 4 minutes, 45 minutes, 6 hours or 3 days. The creators probably preferred to give the user a lot of ready-made intervals than to create a module for their own creativity. The graphic may look like a template.

You can easily and quickly identify the default template for newly opened charts and make changes to all of them at the same time without having to pains to click on each chart separately. Each chart can be detached from the platform and moved, for example, to a second monitor.

Screenshots

Forexpulse

Forexpulse